Understanding the examples of TUI share Price is crucial

TUI Gathering has seen its reasonable portion of highs and lows. As one of the world’s biggest relaxation, travel, and travel industry organizations, the TUI share Price frequently mirrors the fortunes of its prevailing industry.

This article will investigate the exhibition of the TUI share Price throughout the course of recent years. You will find out about the critical occasions that set off sharp ascents and unexpected dives and estimate the eventual fate of TUI shares.

Presenting the TUI bunch

Situated in Germany, TUI Gathering claims travel services, aircraft, lodgings, voyage ships, and retail locations from there; the sky is the limit. With deals over €19 billion, this travel industry goliath serves a great many clients across the globe. TUI rose up out of the consolidation of Preussag AG and Thomson Travel Gathering in 2000. After different name changes and acquisitions, the recently dedicated TUI Gathering was brought into the world in 2007.

Today, it works in north of 100 nations and utilizes 70,000 individuals. By offering an incorporated travel insight, TUI appreciates higher client reliability and rehash appointments.

TUI share Price history

TUI shares are recorded on the London Stock Trade and Frankfurt Stock Trade under the ticker

TUI. This is an outline of the way the stock has exchanged:

- Bull run: TUI share Price partook in a consistent ascent from mid-2016 to a innacle of £12.27 in May 2018.

- Coronavirus crash: the TUI share Price value plunged to record lows under £3 during andemic lockdowns.

- Fractional recuperation: the stock bounced back to over £3 in 2022 in the midst of a movement restart.

Also read : eplus4cars

Going great (2016–2018)

TUI’s stock graph lines were turning upwards in the years, paving the way to 2018. Financial backer certainty mirrored the organization’s flooding benefits. As pay levels rose, clients likewise pined for additional lavish escapes. TUI capitalized on the rising demand for package

vacations in the middle market

The organization’s incorporated plan of action was demonstrating effectiveness. TUI inns and planes took care of visitors to TUI travel and resorts. This permitted enhanced armada and stock administration.

These synergistic impacts let TUI lower costs and lift edges. With the travel industry blasting, the organization’s income and stock cost climbed consistently from 2016 to 2018. In May 2018, the TUI share Price hit an unsurpassed high of £12.27, esteeming the organization at over £7.5 billion. Sky blue oceans and blue skies lay ahead—or so financial backers trusted!

You could likewise prefer to peruse: How Do Offers CFDs Function? A Far-Reaching Guide for Novices

Pandemic dive (2020-22021)

By mid-2020, TUI stayed prosperous. That year, the business served more than 20 million customers. When COVID-19 swept the globe and grounded TUI’s fleet almost immediately, everything changed. With contamination spiraling, specialists prohibited insignificant travel. Lodgings locked their entryways, attractions covered, and travels docked endlessly.

TUI experienced massive misfortunes as appointments evaporated. From April to May 2020, the gathering consumed €740 million. TUI laid off 11,000 UK employees with no prospect of revenue or relief.

Financial backers escaped travel stocks in the midst of the vulnerability. The TUI share Price fell, hitting an unequaled low. The movement closure persevered through 2021. TUI shares deteriorated under £300, burdened by the moving lockdowns. Battered by trip retractions and discounts, TUI required numerous bailouts from the German government. This further dissolved financial backing certainty. However, the most obscure days passed as antibodies permitted travel to restart in 2022.

Fractional recuperation (2022-PPresent)

Repressed requests have revived travel appointments in 2022. Customers actually have investment funds and pass on days to save post-lockdowns. Nonetheless, the area’s recuperation stays delicate. The conflict in Ukraine and record expansion have crumbled shopper feeling by and by.

As Europe’s biggest travel industry organization, TUI stays delicate to outer shocks. The TUI’s stock slid beneath £150 in June. The offer cost has recovered some balance since hitting December lows under £120. Long-term COVID disruptions are still a problem, especially in China, a crucial market.

TUI is estimating a huge profit recuperation this year

TUI is estimating a huge profit recuperation this year. Appointments for summer 2023 flooded by 146%, compared with a year ago. On the off chance that Coronavirus keeps up with its new retreat, TUI’s tasks could standardize throughout the following 12-year and a half. That ought to deliver significant incomes to fix asset reports.

Financial backer positive thinking might fortify assuming that internal certainty from the board emerges into higher deals and edges. There are by all accounts a lot of open runways now for TUI’s stock to rise after its legendary emergency.

Really take a look at this fascinating article: Instructions to purchase, sell, and exchange stocks.

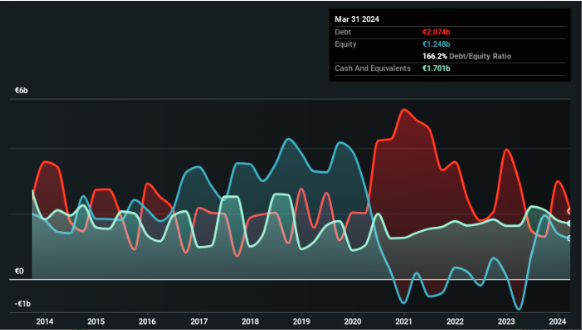

What number of offers does TUI have?

TUI AG presently has a market capitalization of £2.54 billion, with roughly 507.43 million offers in issue. Over the course of the last year, TUI AG’s portion cost has encountered a huge scope of variances, exchanging between a high of 1,723.00 and a low of 131.75, with a distinction of 1,591.25. This demonstrates that TUI AG’s stock has been dependent upon high unpredictability, which might bear some significance with financial backers and examiners the same.

What is the fate of TUI?

In the wake of getting through movement’s most obviously awful at any point shock, what does the future hold for the TUI share Price? Close-term vulnerability waits while high expansion and monetary shortcoming stifle customer spending.

Despite this, travel demand has so far demonstrated surprising inelasticity. Holidays are still important to a lot of customers, and they’re willing to pay more for them. According to the United Nations World Tourism Organization, global tourism is expected to rise by 1% to 2% in 2023.

Homegrown and local travel ought to bounce back faster than long stretches

Homegrown and local travel ought to bounce back faster than long stretches. Market pioneer TUI is all around put to catch this underlying expectation development. The company’s aggressive cost-cutting kept enough liquidity to withstand additional volatility. TUI is likewise financial planning to upgrade intensity post-pandemic. It has, as of late, arranged new planes from Boeing. The organization is speeding up its advanced progress and further developing client encounters.

Dynamic bundling that gives customized trip suggestions ought to raise rehash appointments and lifetime client values. TUI likewise incorporates supportability across its business to line up with moving purchaser needs. TUI may also soon pursue acquisitions to increase market share because of its position to lead industry consolidation.

Generally speaking, by 2024-25, TUI could arise bigger yet more streamlined

Generally speaking, by 2024-25, TUI could arise bigger yet more streamlined, making it an imposing player for what’s to come. Assuming that worldwide development patterns settle throughout the following 10 years, TUI can profit from enormous, underpenetrated markets like India and Africa.

Think about giving this a look: 5 stocks to pay special attention to this new profit season

This wraps up our plunge into TUI share Price throughout the course of recent years. We investigated the ups and downs—from 2018’s top to 2020’s—during the coronavirus travel boycotts.

TUI share Price is steering toward calmer waters as travel emand rises

TUI share Price is steering toward calmer waters as travel demand rises, despite the fact that risks persist today. Its expense cuts and money infusions might pay off as vacationers run back. However, before purchasing TUI stock, investors should keep an eye on consumer trends and financial performance.

We trust this examination gave you a more clear image of the powers impacting this travel industry pioneer. Look out for our next inside and out business profile!